Published: May 2, 2023

Updated: September 4, 2024

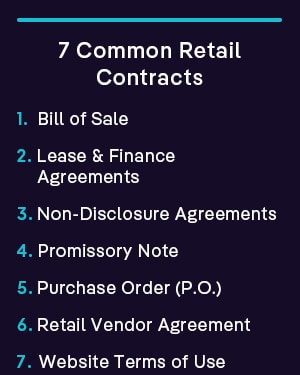

Every agreement that you enter has an impact on your business, which is why understanding the different types of contracts used in retail available helps manage risks and unlock hidden opportunities.

Here’s everything you need to know about 7 common retail contracts and when to use them.

The Importance of Written Contracts?

It is important to have a written contract in a business context to ensure that the details of the transaction are correctly recorded so that there is no confusion or ambiguity between the parties. They can record things like pricing expectations, order amounts, special terms such as exclusive rights but also the process if something goes wrong. In the United States, around 80% of business transactions are governed by contracts. They are invaluable for the longevity of businesses because they create certainty and can confirm long-term business relationships.

7 Common Retail Contracts

1. Bill of Sale

This is a straightforward contract that records a transfer of ownership. Whether you’re selling a car to a neighbor, or selling your business to a new owner, a bill of sale contract would be in place for the exchange. This is especially true for high-ticket items.

Specifically for retail contracts, a bill of sale will detail the specific goods that are being sold, along with the prices agreed upon for the goods. Though easily confused with a sales contract, a bill of sale is used during the exchange or transfer of goods, whereas a sales contract is typically in place before the exchange.

2. Lease and Finance Agreements

These types of contracts are typically used by companies to lease equipment or property. In fact, as of 2022 the global finance lease market reached 849253.2 million and is expected to continue to grow. These types of contracts are popular because they’re a way for companies to avoid high costs associated with things like equipment and can be a more affordable option.

Using a contract management system (CMS) to create and store lease templates can save your retail business time, money, and protect your reputation, liability, and customer loyalty.

Common sections you might find in lease and finance agreements are:

- Lease property

- Delivery and acceptance

- The lease period and rent

- Usage and tax

- Insurance

3. Non-Disclosure/Confidentiality Agreements

Non-disclosure agreements (also known as Confidentiality Agreements are legal documents that protect your business information from being leaked to competitors, vendors, and other third parties. They’re also very useful when it comes to protecting intellectual property and patent rights.

There are two types of non-disclosure agreements: unilateral and mutual. In the unilateral NDA, only one party agrees not to reveal any sensitive information, whereas, in a mutual agreement, both sides agree to not share confidential information. It is always preferable to use a mutual Non-Disclosure Agreement.

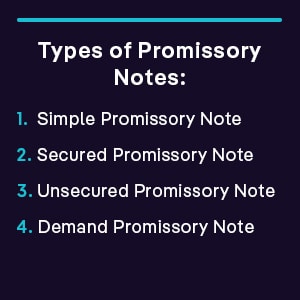

4. Promissory Note

Think of a promissory note as a written promise, except legally binding and secured by collateral or on the promise of repayment. For businesses, a promissory note is useful because it allows them to work with investors with the promise of paying back the money borrowed at a particular time.

Pros of Promissory Note

- They are a legally binding contract, which provides security for the lender and a record of the agreement.

- They are flexible when it comes to terms set in the contract, like interest rates, due dates, etc.

- They are transferable assets. This means that promissory notes can be transferred to other parties, allowing the original lender to assign the debt to a third party if they choose.

Having a contract lifecycle management (CLM) application to store templates for these agreements and review them before physically or digitally signing them can make this process much simpler for you, your customers, and your supplier partners.

5. Purchase Order

A purchase order (P.O.) is a type of contract that formalizes an offer to purchase a referenced good. It typically means that the negotiated terms work for both parties and everybody is ready to move forward with a formal contract. P.O.s are often used to purchase inventory or other low-risk services. One thing to keep in mind, however, is that P.O.s are not legally enforceable until the seller signs it, which will then indicate acceptance in writing.

6. Retail Vendor Agreement

A retail vendor agreement details the relationship between the retailer and a manufacturer or distributor. It outlines the basic terms and conditions of the working relationship established. There are different types of retail vendor contracts and they cover anything from goods and services to day-to-day operations.

Retail Vendor Agreements will typically include:

- How often to make payments

- How much to pay in each payment interval

- The total sum of the contract

- Where to make payments

- If you owe any interest on those payments

- How to resolve disputes

- Conditions around returning goods (both faulty and non-faulty)

7. Website Terms of Use

As almost every business uses some type of online platform to promote and engage with customers, this type of contract is very common today. According to a 2019 report by the Pew Center for Research, one-quarter of adults say they’re asked to agree to the terms and conditions of a company’s privacy policy.

Essentially, this type of legal document sets the rules of engagement with the company site and explains how to avoid potential legal issues. This type of agreement is crucial in minimizing liability and protecting your content in the event of legal issues. They’re a good way to anticipate legal bumps down the road and determine what you need to protect the information on your website.

Examples of Key Clauses Found in Retail Contracts

As a business owner, it’s important to draft contracts with specific goals in mind. Besides formalizing a transaction, the point of a retail contract is to provide a layer of protection and help mitigate risks. When executed properly, adding specific contract clauses can favor your needs and those of your business.

Key Clauses You Should Know About

Force Majeure Clause

When it comes to a business, it’s common for things to happen that are out of either party’s control. For example, think of the impact of a natural disaster. An unexpected hurricane, a wildfire, or an earthquake all have the power to derail shipments and the delivery of goods. What do you do?

By adding the force majeure clause, you’re making sure that you’re not in breach of contract for an unforeseeable disruption. Without this clause, in the event of unexpected changes, parties would have to turn to common law, which is not always likely to remove liability.

Confidentiality Clause

Contracts are rich in intricate and private details. They contain information that, if divulged, could greatly hurt your business. Also known as a non-disclosure clause, the confidentiality clause protects sensitive data that you want to keep away from the public. Things like sales strategy, clients’ confidential information, and financial information are all privy to exposure without this clause in place.

By adding the confidentiality clause to your contract, you’re making sure that neither party divulges any information throughout the contract. Depending on the information at stake, sometimes confidentiality clauses expand further in an NDA.

Indemnification Clause

A big reason to enter a contract is to protect your financial assets and make sure that you don’t experience future financial harm. The indemnification clause helps outline compensation in case there are losses or damages.

By adding the indemnification clause, you’re essentially allocating risks and making sure that you’re protected from lawsuits and damages, while still being able to hold the other party accountable if something goes wrong.

How Can You Handle Negotiations and Legal Considerations?

Contracts go hand in hand with negotiations. Both parties want to protect their assets and make sure they enter a legally binding document in good faith. Because contracts are not one-sided, negotiations will take place to reach an agreement that works for both parties.

Here are some things you should consider ahead of your negotiations:

Negotiation Tips

Even if you’re great at haggling prices with street vendors, coming to a formal contract negotiation requires a little more preparation. This is because when you’re negotiating a contract for your business, there’s more at stake and you always want to act based on the best interest of your business.

Legal Considerations

Retail contracts should be very thorough documents. As such, there are some legal considerations and implications that should be considered when drafting contracts. For example, it’s important to comply with relevant local, state, and federal laws. Additionally, it’s important to include clauses that talk about termination and dispute resolution.

To deliver the best possible outcomes from a contract, it’s helpful to enlist legal experts that can shed light on the retail industry and can make sure that everyone is compliant with the law. Moreover, you can also implement risk management strategies to anticipate and mitigate potential legal risks.

Successful Retail Contracts

Successful retail contracts often involve clear terms that benefit both the retailer and the supplier. For example, Target’s partnership with Apple to create “Apple at Target” mini-stores within Target locations is a successful retail contract. It allows Target to attract tech-savvy customers while giving Apple greater in-store visibility.

Another example is Starbucks’ contract with grocery stores to sell its branded coffee products. This agreement has expanded Starbucks’ reach beyond its cafes, boosting its brand presence in homes and supermarkets. Such contracts thrive on mutual benefits, clear expectations, and aligned business goals.

A third example of a successful retail contract is the collaboration between Nike and Foot Locker. Nike supplies exclusive products and limited-edition sneakers to Foot Locker, which in turn promotes Nike’s brand through its extensive retail network. This partnership has helped Foot Locker draw in sneaker enthusiasts and collectors, while Nike benefits from dedicated retail space and heightened brand exposure in a targeted market. The success of this contract lies in the exclusivity and shared focus on a specific consumer demographic.

What Are the Best Practices for Managing Retail Contracts?

Contracts play a pivotal role in your business. As such, you might find it hard to keep track of all the different contracts in place to keep your business up and running. It’s in the best interest of your business to make sure that you’re in good standing with all the different people and vendors you’re in business with, which is why it’s key to manage retail contracts in the most efficient ways.

Here’s how to do it.

Effective Communication

When it comes to retail contracts, communication is everything. Whether you’re a contract manager or a business owner, to successfully manage all your retail contracts, it’s important to maintain an ongoing dialogue with the parties involved in the contracts. This is a good way to ensure that procedures and processes are being followed by both sides and easily identify areas of expansion, change, and/or any adjustments that need to be made.

Project Management

Because it can be hard to keep up with all the contracts in place, project managers can make use of project management methodologies to help them ensure projects are running smoothly from beginning to end. Some of them are:

Waterfall: This methodology offers the most traditional approach to project management by showcasing the phases of the project in a downward flow, similar to a waterfall. While this tool adapts to different industries, it’s particularly useful for contracts in the manufacturing and construction spaces.

Agile: If you’re looking for a better way to organize everything across teams, then Agile is the best methodology for you. With Agile, you can collaborate on projects as a team and create timelines that are fast and flexible depending on the project. Agile works best for software development companies but adapts well to non-software-related projects seeking to drive innovation.

Lean: With Lean, project managers can utilize this methodology to optimize assets and verticals in retail contracts and ongoing projects. Lean is particularly useful because it focuses on the continuous improvement of the development process. Although Lean works mainly for manufacturing industries, it’s also used in education and software development.

It’s likely that some of the contracts you’re in have time limits or specific deadlines that can make or break a project. By having effective project management methodologies, you’re ensuring that the quality of work is up to par and that you can manage resources in a way that benefits the company, along with all the stakeholders.

Attention to Detail

Often, contracts require a great amount of detail before execution. Even when contracts are in place, contract management still requires attention to detail as there are a lot of nuances involved in each clause.

It’s crucial to try to avoid pitfalls when it comes to details, as there are aspects of a contract that benefit from specificity. For example:

- Ambiguous terms and conditions

- Inconsistent contract language

- Poor record-keeping

- Overlooking renewal and termination dates

To avoid these types of pitfalls, it’s important to implement robust compliance and carefully review all contract terms. Additionally, conducting periodic audits ensures ongoing adherence to the standards outlined in the original contracts.

Capitalize on Every Opportunity

In the dynamic world of retail, understanding and effectively managing contracts is crucial for business success. The seven common retail contracts outlined in this blog provide a foundation for navigating various business transactions, from securing equipment leases to safeguarding sensitive information with NDAs. By mastering these contracts and their appropriate use, you not only protect your business but also position it for long-term growth.

Effective contract management, coupled with strategic negotiations and attention to detail, ensures that your business operations run smoothly and that you can capitalize on every opportunity while mitigating potential risks.

Learn more about our retail solutions and see how they are already enhancing efficiency for businesses.